Bitcoin trading signals to watch

As Bitcoin goes back over the $100,000 mark I thought it important to highlight some key trends I see that you can use to avoid any potential losses.

There are some key trends I'm picking up here that will hopefully help you make informed decisions about trading the next couple days. Let's dig into the charts by click on the TradingView dashboard below to view my Bitcoin setup that I'm watching.

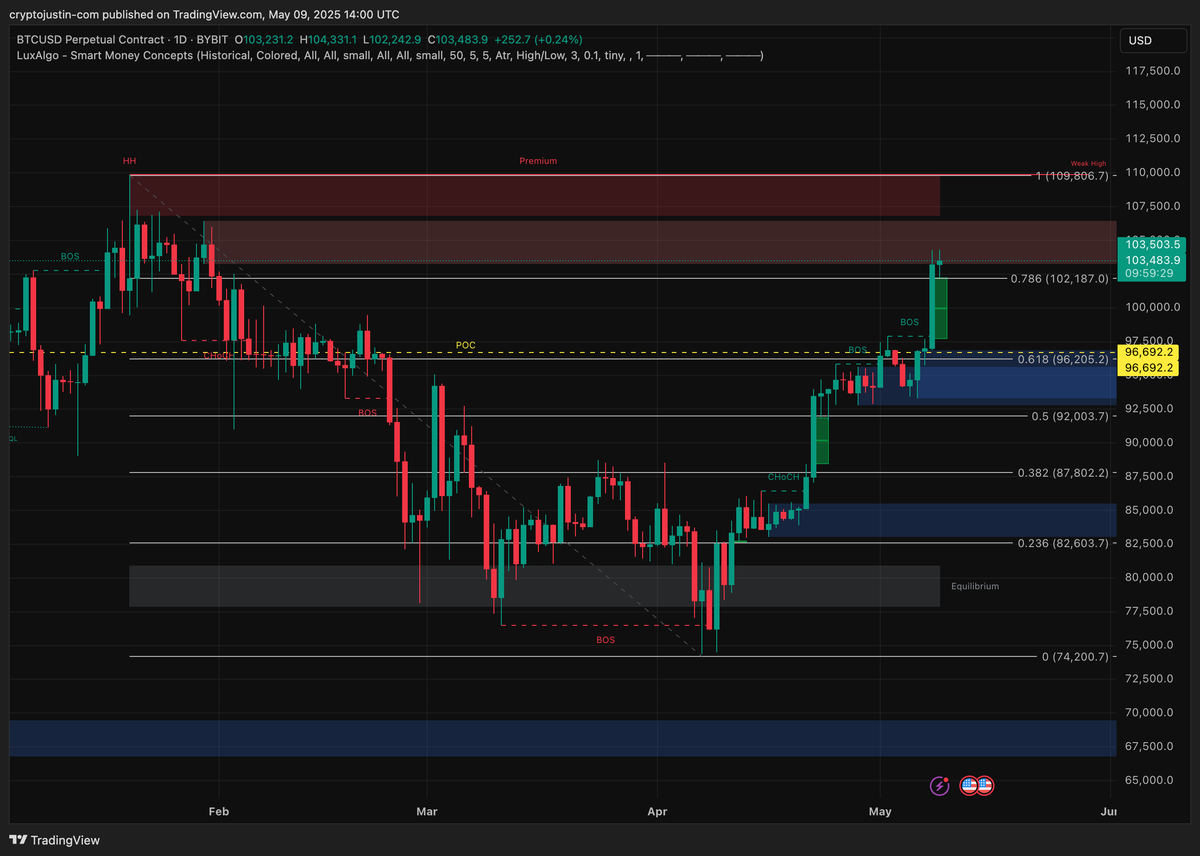

- The first thing to note is that we've hit the resistance. The red bar below the Premium range tells us this so I would not be looking for any longs.

- The same goes for any buying. You don't want to buy in the Premium zone - look for prices at either the Equilibrium or Discount zones.

- We've had two consecutive Break of Structures (BOS) which essentially means we've hit new Higher Highs. This happened on the 1st of May and yesterday. This could indicate another BOS but that would be a few days at best and because we're so close to the resistance I would err on the side of caution.

- The blue zones sitting at between $93,302-$95,635 and $83,080-$85,344 indicate where the cash flow is sitting for long positions. If you're looking for a decent long position, enter there.

The liquidity heat-map has some interesting insights too. Have a look at it below.

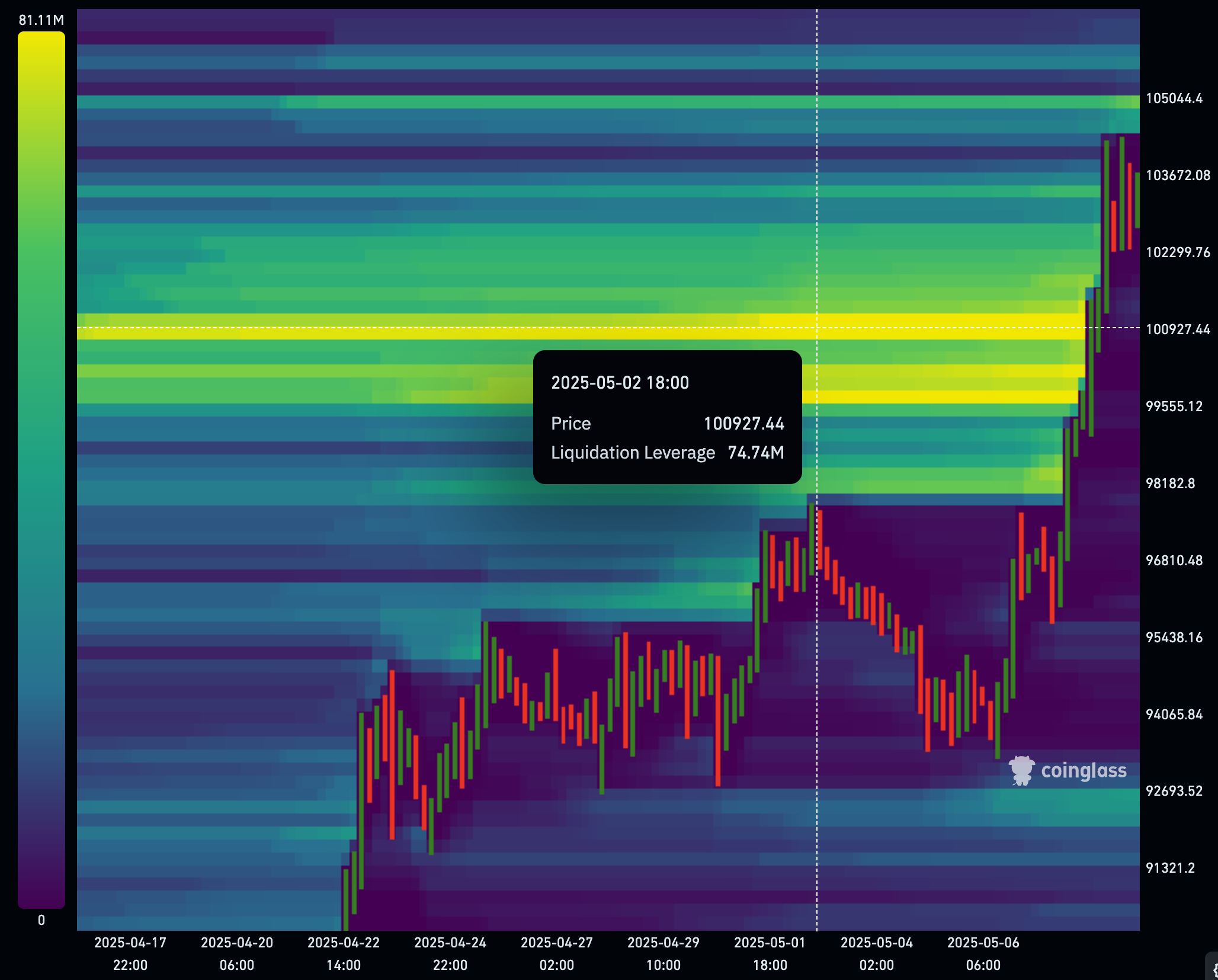

The bright yellow indicates where the liquidity sits at it highest concentration and experience has shown that bars are pulled towards these bright yellow zones like magnets. I have highlighted the $100,927 mark for Bitcoin as this is the next highest liquidity concentration to watch.

The key takeouts of both these charts is that long positions don't seem likely unless we break the resistance of where we're currently at. This is an opportunity for shorts though because if we start to see a downward trend the cash suggests we'll end up at that $100,927 mark.

If we do hit $100,927, I would expect we could see further decline down to the first blue zone of the TradingView chart in that $93,302-$95,635 zone. If we hit this zone, longs become a very real consideration here.

Let me know if you have any questions and get in touch with me!

Safe trading folks!